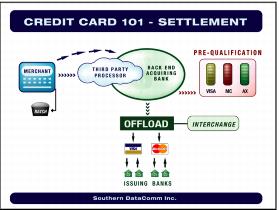

Settlement process flow

Settlement/funding process of credit card batches

1. Salespoint/ProtoBase

• Deposits the credit card batch to the third-party processor

2. Third-party processor

• Collects batches from all of their merchants and passes them to their back-end early in the morning around 2 AM

3. Backend processor acquirer

• Sorts through all of the batches and creates an offload record containing transactions for all the merchants sorted by card type

• Performs pre-qualification on the transactions to determine the rates associated with the transactions

• Funds the merchant based on the transactions pre-qualification

• Transmits the offload to the card association

4. Card association/interchange

• Sorts through the offload record and creates a batch of transactions for each issuing bank

• Performs interchange where it scrutinizes the transactions for compliance data looking for items such as card-swipe, item detail, tax amount, etc.

• Transmits their batches to the issuing banks

5. Issuing Bank

• Makes credits and debits to card holders account

• Transmits electronic funds through ACH to card association minus interchange fee’s

6. Card association funds the acquiring bank minus the interchange fee’s

• Acquiring bank may bill the difference in interchange fee’s to merchant

Rates/compliance

Discount rate = Best rate a merchant can qualify for. This rate is based on:

1. Industry

• Level of risk involved in taking that transaction

• Retail module transactions contain card swipe data

• Signature is verified

• Card is present – Face-to-face transaction

2. Anticipated volume of transactions

• The more transactions the merchant processes the better rate they can expect to get assuming their transactions are compliant

3. Downgrade – When the transaction does not meet the qualifications for compliance for that industry type. Information such as card swipe and transaction detail is missing from the transaction. Batches must be settled in a timely manner.

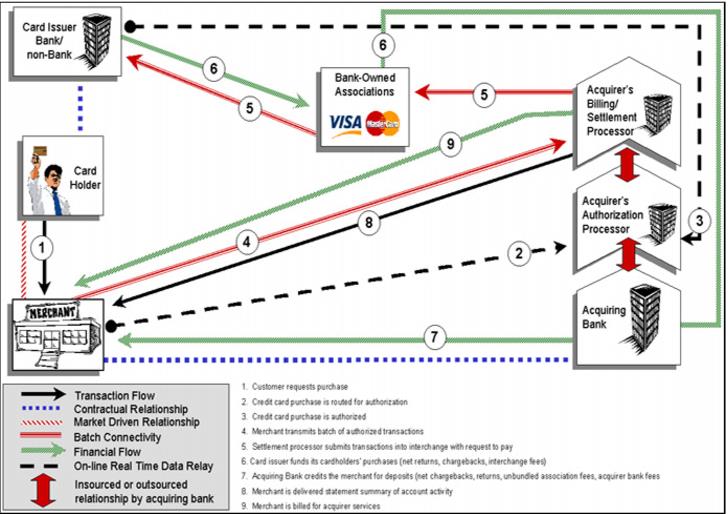

The overall authorization and settlement process is summarized in the following diagram: